The Travelling Slacker

India Beyond Cliche’s

Notes from the Hinterlands

Travelling Slacker has been a source of informative travel content on Indians’ remotest corners since 2011. While not averse to other explorations, the bulk of the writings here focus on the Himalayas and North East India, along with some obscure archaeological and ethnocultural experiences. This blog is committed to promoting responsible explorations and documenting the people, culture, and history of these lands.

Recent Posts

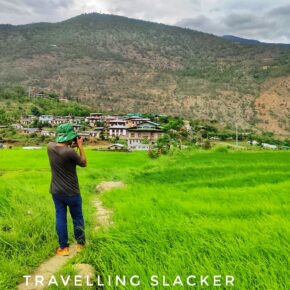

- Tiger’s Nest Trek, Paro Taktsang

- Sela Pass: Floating Peaks, Frozen Lakes & A New Tunnel

- Digboi: Of Oil & War

- Tezpur: Where the Wingwoman Takes the Centerstage

- Jaisalmer Travel Guide: Fort, Havelis, Lake, Thar Desert Safari, Museums & More

- Dehing Patkai National Park: A Morning Hike Through The Rainforest

Sign up for Exclusive Content

As Seen On:

Buy My Book

Immersive Arunachal: A Traveller’s Handbook

An ideal travel companion to Arunachal Pradesh that has been designed to be backpacker-friendly, no-frills, and up to date. It discusses 13 different circuits in the state and explains all possible aspects in a comprehensive manner.

Work With Me

Get in touch for collaborations and freelance assignments.

01.

Travel Collaborations

Want to spread the words about a new and unique experience? Need better coverage for your eclectic endeavors?

Get in Touch.

02.

Content Marketing

Want to improve your online presence through sponsored content, copywriting services, linkbuilding and SEO?

Get in Touch.

03.

Consultation

Need more insights into the state of travel and tourism market as well as the Indian blogging & influencer marketing scene?

Get in Touch

Get in Touch

Detailed Travel Guides

- Hornbill Festival 2023: A Complete Travel Guide

- Anini Travel Guide: (Mayudia- Roing & Hunli)

- Spiti Valley Travel Guide: Cold Desert with Warm Hospitality

- Ukhrul & Shirui Lily Festival Travel Guide

- Chopta Travel Guide: Tungnath-Deoria Tal-Kartik Swami-Trekking

- Majuli Travel Guide: A Comprehensive Blog

Himachal

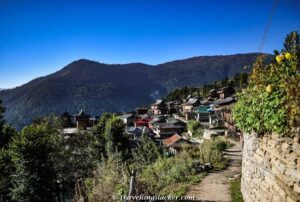

- Dodra Village: Amaranths beyond Chanshal

- Autumn in Spiti: Fall Colours in September-October

- Sach Pass Crossing: Travelogue & Travel Guide

- Why is a Snow Leopard Tours Cost So High?

- Serolsar Lake Trek: A Quick Detour from Jalori Pass

- Fagli Festival (Phagli) at Sharchi, Tirthan Valley

Uttarakhand

- Bhavishya Badri Trek, Joshimath: Future Deity & Some Serendipity

- Chopta Travel Guide: Tungnath-Deoria Tal-Kartik Swami-Trekking

- Kasar Devi: A Slice of Hippie Himachal in Kumaon

- Pithoragarh: The Rite of Spring

- Patal Bhuvaneshwar: The Ultimate Kumaoni Delight No One Told You About

- Deoria Tal: Mini Trek, Mythical Break

Ladakh

- Leh Bus Service from Delhi, Manali and Keylong 2023

- Ladakh Travel Guide: A Comprehensive Blog for Backpackers

- Famous Tourist Places to Visit in Ladakh: Leh, Nubra, Chanthang, Kargil, Zanskar

- Ladakh Permits: Inner Line Permits (ILP), PAP & RAP : Domestic & Foreign Visitors

- Hunder Sand Dunes, Nubra Valley: Bactrian Camels of Silk Road

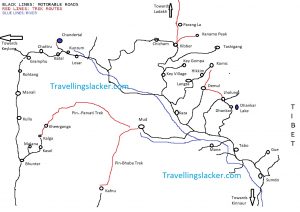

- Ladakh Map, India (Tourist Routes to Leh, Nubra, Changthang, Kargil, Zanskar )

Northeast India

- Sela Pass: Floating Peaks, Frozen Lakes & A New Tunnel

- Digboi: Of Oil & War

- Tezpur: Where the Wingwoman Takes the Centerstage

- Dehing Patkai National Park: A Morning Hike Through The Rainforest

- Hornbill Festival 2023: A Complete Travel Guide

- Tawang Travel Guide: (Including Dirang, Bomdila, Shergaon & More)

Heritage

- Jaisalmer Travel Guide: Fort, Havelis, Lake, Thar Desert Safari, Museums & More

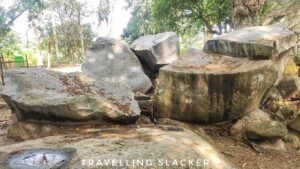

- Deopahar Archaeological Site: Flying Nymphs of Numaligarh

- Eran Varaha Temple: A Porcine Nostalgia

- North Guwahati: Ashwaklanta & Dirgheswari Temples

- Kanai Boroxi Boa Rock Inscription & Prithu: What Happened to Bakhtiyar Khalji after destruction of Nalanada

- Urvashi Island: Meeting the Winter Nymph of Guwahati

Wildlife

- Dehing Patkai National Park: A Morning Hike Through The Rainforest

- Best Offbeat National Parks to visit in India

- Satpura National Park: Crouching Tiger, Blazing Kusum

- Khichan: A Hitchcockian Delight

- Bagori Range of Kaziranga: A Quick Morning Jeep Safari

- Hues of Ramganga: Beating Around the Bushes in Corbett

Decoding Delhi

- Delhi Beyond Clichés: 10 Offbeat & Unusual Things No One Told You To Do In Dilli

- Paharganj Alternatives: Finding Safe Budget Hostels in Delhi

- Feroz Shah Kotla: Fortress of the Spirits

- Asola Bhatti Lakes: Nameless Delights of the Lawless Backyard

- Delhi Textile Trail: A Journey Through Threads, Textures, and Time

- Jamali Kamali: TCBG_Trips With Rana Safvi

Partner Content

- Boosting Global Travel Experiences with the Power of Bitcoin and Digital Nomadism

- Casinos in India: Some Betting Tips and A Review of 1Win

- Top Travel Tips for Exploring a Foreign Country

- Luggage Storage at Airports: Pros and Cons